Banks and fintechs should collaborate more to accelerate financial inclusion, says John Apea, Chief Executive Officer of eTranzact Ghana.

He said by working together, traditional financial institutions and financial technology firms (fintechs) can leverage their unique capabilities to ensure that majority of Ghanaians are brought within the financially included bracket.

An effective collaboration between the two will also build solid foundation and systems that are relevant to the Ghanaian market.

“Previously, we had a lot of unbanked people who couldn’t do transactions online, but what fintechs have been able to do is that they have been able to short-circuit us by enabling us to do what was previously not available. So your phone can be your bank; you can do transfers quickly.

“So fintechs have made the world much smaller in terms of including people who previously were financially excluded,” Mr. Apea told the B&FT.

Much of the success in the fintech space, he explained, has been chalked by working closely with traditional financial institutions to either improve on existing infrastructure or introduce innovative ones that bring both convenience and real value to customers.

More importantly, he said much more collaboration is required to localise financial products and services like payment solutions to the ever-changing needs of the domestic market.

“It is about time we started to have a system for us, by us that would recognise our different intricacies, and able to leverage on those intricacies to be able to promote economic development,” Mr. Apea said.

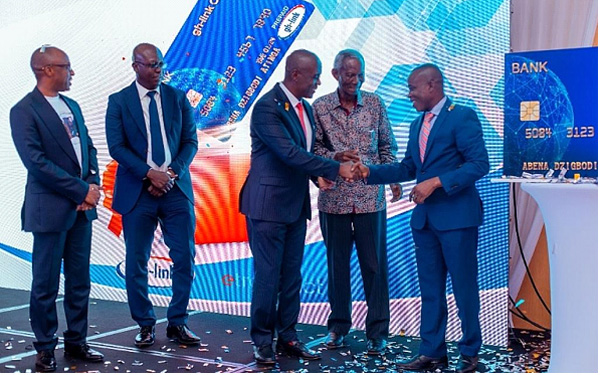

For instance, he said eTranzact, a leading electronic payments and service aggregation solutions provider, is able to support local financial institutions to issue GHLink cards – a domestic card payment scheme hosted on the Ghana Interbank Payment & Settlement System (GhIPSS) platform – at much cheaper cost.

By processing those cards here, he said, banks can significantly cut down on the huge sums they spend processing card transactions outside the country. This will also translate into cheaper card transaction fee for debit and credit card users.

“If we had payments systems linked to Pan-African payment processors like eTranzact, it will bring the real strength of the African economy out,” he said, adding: “So, what we do at Etranzact is very important because it has brought a lot of people into the technology space; it has brought a lot of people into the banking space, and it opens up opportunities for the informal market.”

“If we had payments systems linked to Pan-African payment processors like eTranzact, it will bring the real strength of the African economy out,” he said, adding: “So, what we do at Etranzact is very important because it has brought a lot of people into the technology space; it has brought a lot of people into the banking space, and it opens up opportunities for the informal market.”

He further commended the Bank of Ghana for setting up a fintech department to support the financial technology space to flourish.

1

1 waitfor delay ‘0:0:15’ —

-5) OR 184=(SELECT 184 FROM PG_SLEEP(15))–

vDR9PpKz’) OR 837=(SELECT 837 FROM PG_SLEEP(15))–

1*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

1’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

I read this piece of writing completely about the

resemblance of most up-to-date and previous technologies, it’s remarkable article.

Here is my blog :: vpn special coupon code 2024

Hi there! This is my 1st comment here so

I just wanted to give a quick shout out and say I really enjoy reading

your posts. Can you suggest any other blogs/websites/forums that

cover the same subjects? Many thanks!

Very nice write-up. I absolutely love this website. Stick with it!

Feel free to visit my page … vpn coupon 2024

Hey there! This is kind of off topic but I need some

guidance from an established blog. Is it tough to set up your own blog?

I’m not very techincal but I can figure things

out pretty fast. I’m thinking about making my own but I’m not sure where to begin. Do you

have any points or suggestions? Appreciate it

My website; vpn code 2024

Hmm is anyone else encountering problems with the images on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the

blog. Any feed-back would be greatly appreciated.

My site vpn special coupon code 2024

Hello there! I could have sworn I’ve visited

your blog before but after going through many of the articles I realized it’s

new to me. Anyhow, I’m certainly happy I discovered it and I’ll be book-marking

it and checking back frequently!

Keep on writing, great job!

Stop by my webpage; vpn code 2024

Hello, I desire to subscribe for this webpage to get hottest updates, so where can i do it please

assist.