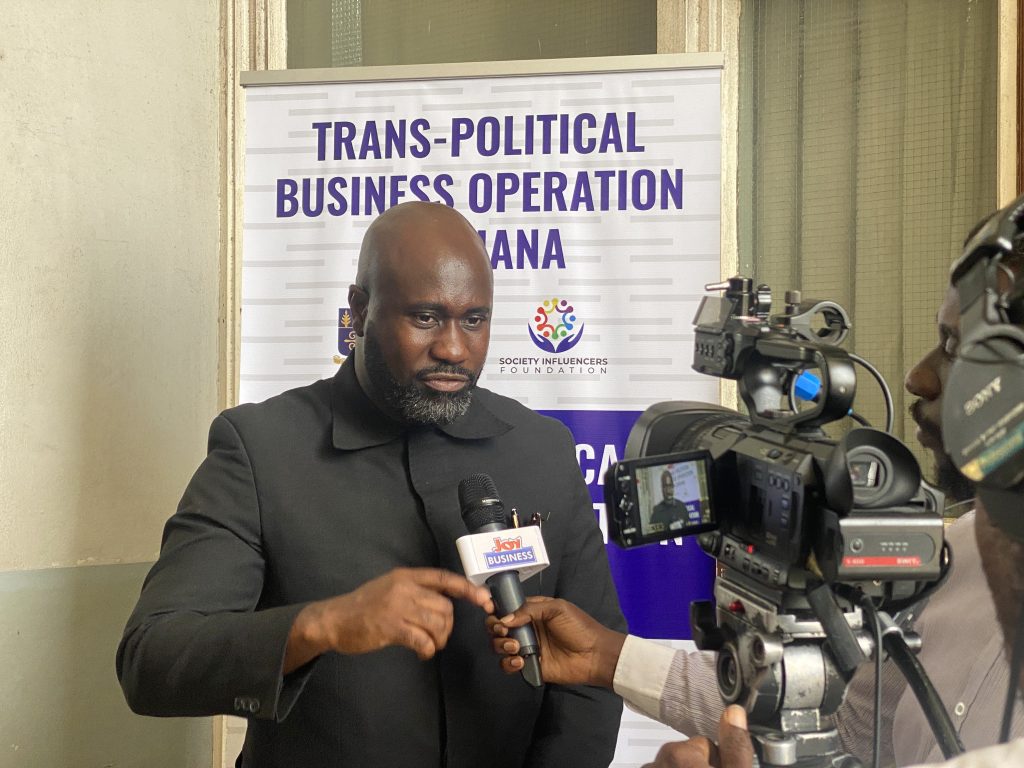

Babafemi George nominated Africa’s 100 ‘Most Impactful Change Maker’

The Executive Director, eTranzact Ghana Ltd., Babafemi George, has been nominated as one of Africa’s top 100 ‘Most Impactful’ Change Makers for the year 2022, by the Humanitarian Awards Global (HAG). The nomination is in recognition of his leadership role in the establishment of a leading financial technology entity at the forefront of delivering cutting-edge […]

Babafemi George nominated Africa’s 100 ‘Most Impactful Change Maker’ Read More »